TUESDAY, MARCH 25 @ 6:30 – 8:30 PM PACIFIC

ONSITE AND ONLINE MEETING ON ZOOM

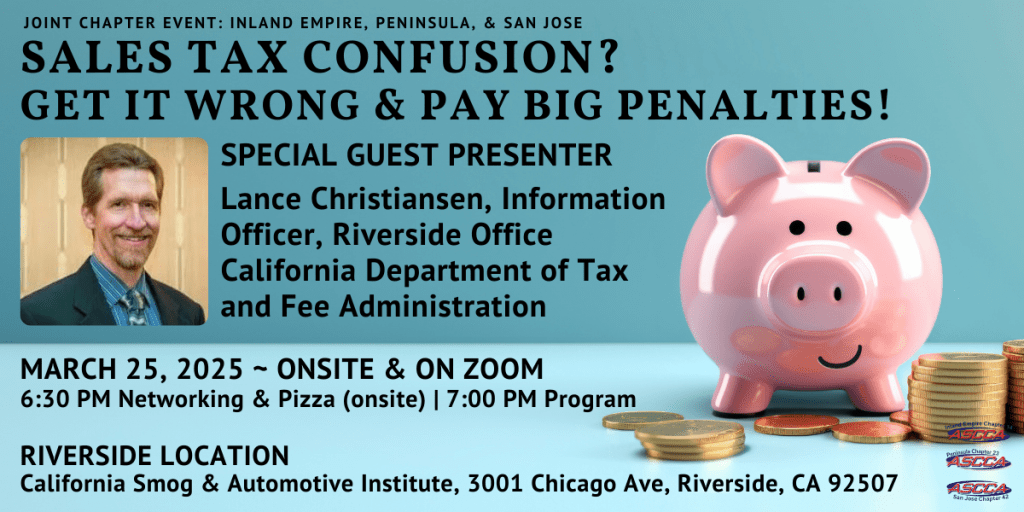

Running a successful auto repair shop means more than just fixing cars—you also need to understand your tax obligations. Join us for this specialized training to “open the hood” on sales and use tax laws specific to automotive repair businesses.

Why You Should Attend

In this informative session, you’ll gain clarity on:

✅ The taxability of parts and labor—when to charge sales tax and when it’s exempt

✅ Tools and supply items—what’s taxable and what qualifies for an exemption

✅ Proper invoicing—how to structure your invoices to stay compliant

✅ Use tax & resale certificates—when and how to apply them correctly

✅ Sublet repairs—tax implications when subcontracting work

✅ Vehicles for resale—special rules for repair work on dealer-owned vehicles

✅ Tires, batteries, glass, paint, and bodywork—unique tax considerations for these items

Whether you’re a shop owner, service advisor, or accountant, this class will help you navigate California’s complex tax regulations and avoid costly mistakes.

Don’t miss this opportunity to ensure your shop stays compliant and financially efficient!

For more details on California sales and use tax, visit the California Department of Tax and Fee Administration (CDTFA).

Here’s what you need to know:

📅 Date: March 25, 2025

🕡 Time: 6:30 PM – Onsite; 7:00 PM – Welcome, Industry Updates, Program

📍 Location: Online and Onsite:

Onsite in Riverside: 3001 Chicago Ave Riverside, CA 92507

Online on Zoom: register to receive the login information

Our meetings are open to ASCCA members throughout California, not just San Jose. Don’t miss this opportunity to enhance your skills and connect with fellow professionals.

- All ASCCA Chapter Members and their guests attend this event for free

- Non-member guests will be invoiced for $50

- REGISTER NOW to get the Zoom link:

www.ascca-03252025.eventbrite.com

Bring your friends, family, shop employees, or potential new chapter members!

Don’t miss this chance to ask questions, learn, and get advice from professionals in the industry.